- Luật

- Hỏi đáp

- Văn bản pháp luật

- Luật Giao Thông Đường Bộ

- Luật Hôn Nhân gia đình

- Luật Hành Chính,khiếu nại tố cáo

- Luật xây dựng

- Luật đất đai,bất động sản

- Luật lao động

- Luật kinh doanh đầu tư

- Luật thương mại

- Luật thuế

- Luật thi hành án

- Luật tố tụng dân sự

- Luật dân sự

- Luật thừa kế

- Luật hình sự

- Văn bản toà án Nghị quyết,án lệ

- Luật chứng khoán

- Video

- NGHIÊN CỨU PHÁP LUẬT

- ĐẦU TƯ CHỨNG KHOÁN

- BIẾN ĐỔI KHÍ HẬU

- Bình luận khoa học hình sự

- Dịch vụ pháp lý

- Tin tức và sự kiện

- Thư giãn

TIN TỨC

fanpage

Thống kê truy cập

- Online: 223

- Hôm nay: 198

- Tháng: 1621

- Tổng truy cập: 5245625

The Global Impact of a US Recession

Last week, there was a great deal of talk about an impending U.S. recession. On Wednesday, U.S. Federal Reserve Chairman Jerome Powell indicated the Fed would not increase interest rates this year amid signs of a modest economic slowdown. On Friday, three-month yields on U.S. treasuries briefly rose higher than those of 10-year treasuries – the first such inversion of the yield curve (a historically reliable predictor of a recession when inverted for an extended period) since 2007. And stock markets around the world have responded accordingly.

This is one time when I agree with the speculation. In our 2019 Forecast, we indicated that the United States was due for a recession. Since before World War II, no period of economic growth has lasted longer than 10 years. With the last recession having ended in 2009, we’re now reaching that benchmark. But another important indicator is the labor market. Economics teaches that wealth is generated through land, labor and capital. The U.S. unemployment rate is around 4 percent, about as close to full employment as possible, and that means the labor component of growth is being tapped out. To attract workers, companies will have to pay more for labor, and that will result in declining profit margins or rising prices for consumers. As a result, lower-cost competitors, particularly those outside the United States, will take a larger market share.

This is one of the ways that economies regulate themselves to limit inefficiencies that arise during periods of economic expansion. Economic growth encourages inefficient businesses to absorb resources that would be better deployed in more profitable companies. If this continues, the allocation of resources becomes increasingly irrational. When this irrationality is protected by state intervention to avoid short-term political problems, the economy deteriorates. There are many examples of countries that have used short-term means to postpone recessions, only to wind up in a long-term, insoluble economic malaise. Thus, the business cycle – in which a period of economic growth inevitably leads to recession – is painful but essential.

The question is, how long will the economic irrationality continue to build until the economy moves into recession? In the United States, the limit for economic expansion has been 10 years, so it would be surprising if we did not have a recession fairly soon. It should also be remembered that, since a recession is defined as two consecutive quarters of economic contraction and since numbers on gross domestic product come out about two months after the end of a quarter, we will be in recession for about eight months before it’s officially announced. But it should be fairly obvious that the country is in recession even without an official confirmation. The most painful recessions are accompanied by massive financial crises, like the one experienced in 2008, but most are primarily cyclical in nature.

What I’ve outlined here may be obvious to some, but it’s important to bear in mind the logic and necessity of recessions, which are frequently blamed on political decisions. And that is a necessary point of departure to discuss the geopolitical ramifications of an American recession. The principles that drive recessions in the U.S. are no different than those in other countries. But the consequences for the international system are far more significant.

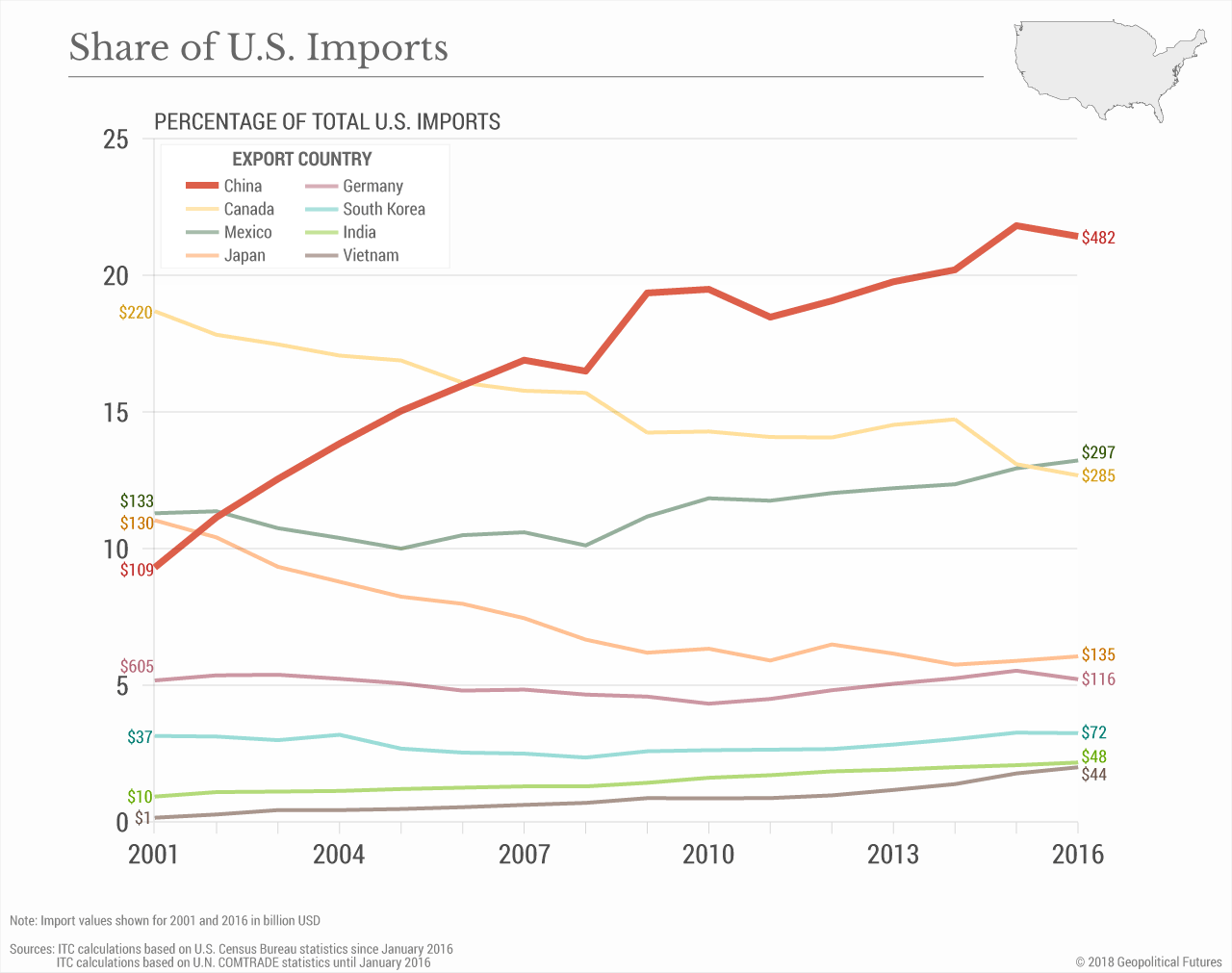

The United States accounts for nearly one-quarter of the world’s GDP. It is the largest importer of goods and services in the world – consuming about 14 percent of total exports. It’s also the largest export destination for China, India and Germany and second-largest for Japan. These four major economies are heavily dependent on exports – nearly half of Germany’s GDP comes from exports, for example – so a global decline in demand has the potential to affect their financial systems, employment rates and even internal political dynamics.

The United States, by comparison, is fairly insulated from the global economy. Only about 13 percent of its GDP comes from exports, nearly half of which go to Canada and Mexico. The three countries form a stable trading bloc, the occasional histrionics notwithstanding. The relatively low dependency on exports limits the United States’ exposure to foreign business cycles. But countries that are heavily dependent on exports are vulnerable to fluctuations in global demand, especially from the world’s largest economy. And because a U.S. recession would decrease consumer demand for goods, it could also – depending on its severity – have a significant effect on the business cycles in other countries. The greater the dependence on exports, the more destabilizing the effect of an American recession.

Some of the most vulnerable economies are already facing serious challenges that would be compounded by a decline in exports. China, for example, is already in an economic downturn. In Germany, there have been some signs of a slowdown in manufacturing and the economic implications of Britain’s exit from the European Union are still uncertain.

The economic and political effects of the last global recession still linger more than a decade later. Many countries are still recovering, though the United States’ economy has proved more robust than those of nations like China, Russia or Germany. These countries are, oddly enough, more vulnerable to an American recession than even the United States. That’s partly because an American recession not only affects direct exporters to the U.S. but also the price of goods and services, especially industrial minerals like oil. Given that it seems the next recession will be relatively mild, as there is no attendant financial crisis in sight, the impact may be limited.

The point about vulnerability challenges the doctrine of interdependence. Countries that are more intertwined in the global economy are more vulnerable to events in other countries; those that are less intertwined can, within limits, control their own fates. This became clear in 2008, and the next recession will simply drive the point home. The political lesson that should have been learned was that the greater the dependence on exports, the greater the vulnerability to the consumer. This point should have been obvious already but was forgotten after many years of general prosperity. It will become even more apparent, however, after each successive recession. The problem for countries like Germany and China is that it would be exceedingly hard to reduce their dependence on global markets, and that will have political consequences.

In the meantime, the U.S. business cycle will run on its own clock, and not on others’. It is the argument for strategic economic prudence, which is odd to say since the U.S. is regarded as economically imprudent, particularly by its own citizens.

By GeoPoliticalFutures

Các bài viết khác

- Siêu cường sụp đổ chính sách đối ngoại của Mỹ từ chiến thắng đến kiêu ngạo (08.05.2019)

- Quan chức Trung Quốc kéo dài chuyến đi thương mại của Hoa Kỳ khi mối đe dọa thuế quan tăng vọt (08.05.2019)

- Sự khác biệt giữa Ý và Tây Ban Nha ngày nay (08.05.2019)

- Đàm phán thương mại Mỹ-Trung: Phe “diều hâu” đang thắng thế? (08.05.2019)

- Chỉ bằng hai đoạn tweet, ông Trump nhấn chìm chứng khoán toàn cầu vào sắc đỏ (08.05.2019)

Yahoo:

Yahoo: