- Luật

- Hỏi đáp

- Văn bản pháp luật

- Luật Giao Thông Đường Bộ

- Luật Hôn Nhân gia đình

- Luật Hành Chính,khiếu nại tố cáo

- Luật xây dựng

- Luật đất đai,bất động sản

- Luật lao động

- Luật kinh doanh đầu tư

- Luật thương mại

- Luật thuế

- Luật thi hành án

- Luật tố tụng dân sự

- Luật dân sự

- Luật thừa kế

- Luật hình sự

- Văn bản toà án Nghị quyết,án lệ

- Luật chứng khoán

- Video

- NGHIÊN CỨU PHÁP LUẬT

- ĐẦU TƯ CHỨNG KHOÁN

- BIẾN ĐỔI KHÍ HẬU

- Bình luận khoa học hình sự

- Dịch vụ pháp lý

- Tin tức và sự kiện

- Thư giãn

TIN TỨC

fanpage

Thống kê truy cập

- Online: 223

- Hôm nay: 198

- Tháng: 1621

- Tổng truy cập: 5245625

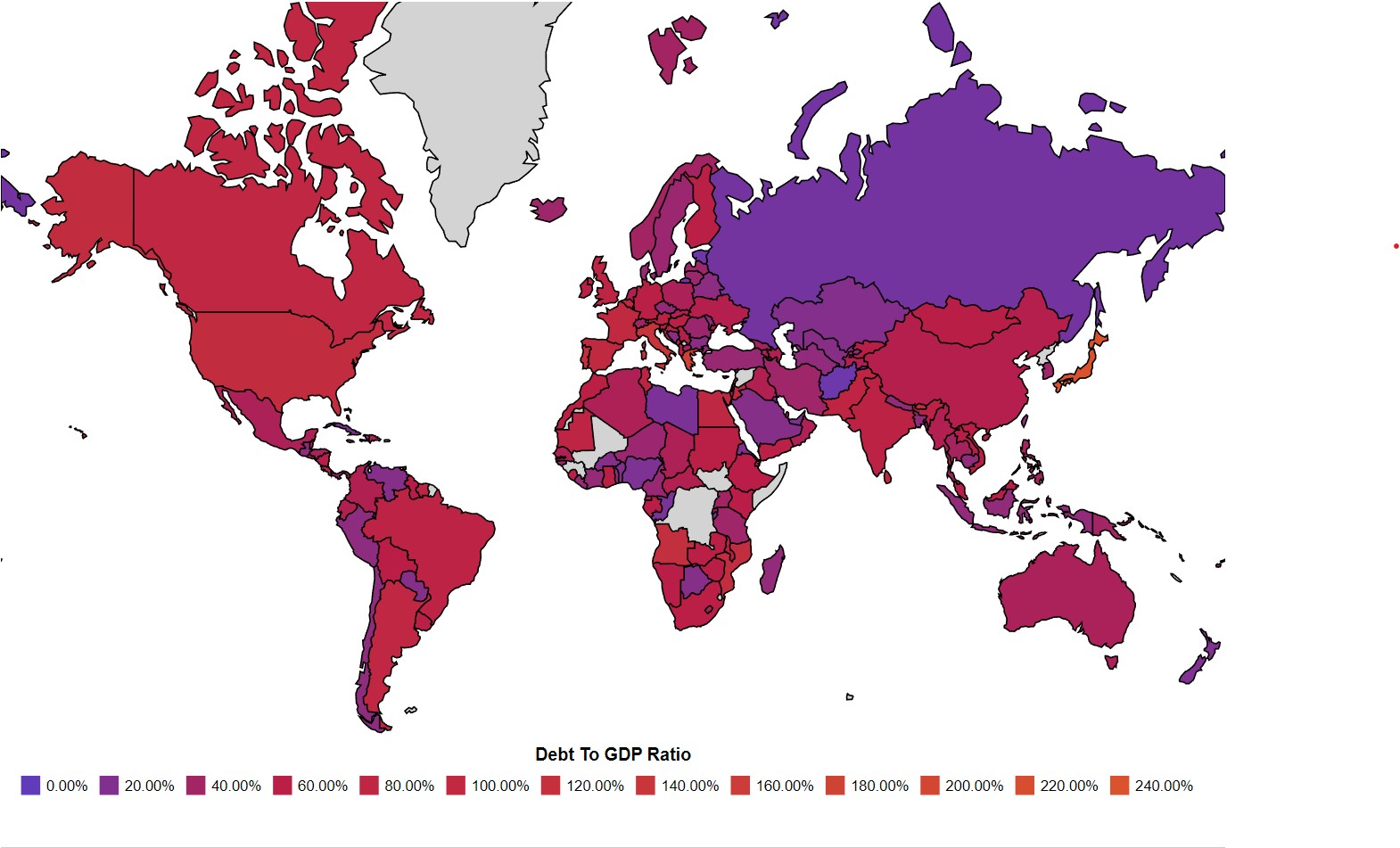

Debt to GDP Ratio by Country 2022

Debt-to-GDP ratio is an economic metric that compares a country's government debt to its gross domestic product (GDP) (which represents the value of all goods and services produced by the country). Typically used to determine the stability and health of a nation's economy, debt-to-GDP ratio is expressed as a percentage and offers an at-a-glance estimate of a country's ability to pay back its current debts. Nations with a low debt-to-GDP ratio are more likely to be able to repay their debts with relative ease. Nations whose economies struggle to produce income or which have an oversized debt tend to have a high debt-to-GDP ratio. Debt-to-GDP ratios above 77% can hinder economic growth and (in some cases) place a country at risk of defaulting on its debts, which could wreak havoc on its economy and financial markets.

Top 12 Countries with the Highest Debt-to-GDP Ratios (%)

- Venezuela — 350%

- Japan — 266%

- Sudan — 259%

- Greece — 206%

- Lebanon — 172%

- Cabo Verde — 157%

- Italy — 156%

- Libya — 155%

- Portugal — 134%

- Singapore — 131%

- Bahrain — 128%

- United States — 128%

As of December 2020, the nation with the highest debt-to-GDP ratio is Venezuela, and by a considerable margin. The South American country has what may be the world's largest reserves of oil, but the state-owned oil company is said to be poorly managed, and Venezuela's GDP has plummeted in recent years. At the same time, Venezuela has taken out massive loans, adding to its debt burden, and president Nicolas Maduro has made questionable moves to slow the country's rampant inflation.

Japan occupies the second slot with a ratio of 266%. In 1992, Japan's Nikkei (stock market) crashed. The government bailed out banks and insurance companies, providing them with low-interest credit. Banks were consolidated and nationalized, and other stimulus initiatives were used to help the struggling economy. However, these actions caused Japan's debt to increase dramatically.

Another interesting entry on this list is the United States, whose debt-to-GDP ratio ranks 12th out of all the world's countries. While the U.S. boasts the highest GDP in the world,, it nonetheless spends more than it earns. Major contributors to the national debt include the world's largest military budget, tax cuts (which reduce government income and rarely result in a corresponding increase in economic growth), COVID-19 relief efforts, and mandatory-but-underfunded programs such as Medicare.

Top 12 Countries with the Lowest Debt-to-GDP Ratios (%)

- Brunei — 3.2%

- Afghanistan — 7.8%

- Kuwait — 11.5%

- Congo (Dem. Rep.) — 15.2%

- Eswatini — 15.5%

- Burundi — 15.9%

- Palestine — 16.4%

- Russia — 17.8%

- Botswana — 18.2%

- Estonia — 18.2%

While a low debt-to-GDP ratio is generally desirable, it does not necessarily indicate a healthy economy. Many stagnant or developing economies have a low debt-to-income ratio because both their level of debt and their GDP are low. In fact, in some cases, a country's economy could be healthier in the long run if the country were to borrow from another country and invest heavily in economic growth. This would increase the borrowing country's debt-to-GDP ratio temporarily, but could also grow the economy (and GDP) enough to pay off the debt and continue earning increased profits in the future. However, because economic growth is not guaranteed, such borrowing could also backfire (as it arguably has for Venezuela).

Source : Debt to GDP Ratio by Country 2022 (worldpopulationreview.com)

Các bài viết khác

- Vài nét Dự báo thời đại phục hưng và khai sáng của loài người sau đại dịch Corona-2019.7-2021(khởi đầu từ tháng 9 năm giáp thìn 2024) (25.06.2021)

- Từ sự kiện Tổng biên tập báo TIME Greta Thunberg là Nhân vật của năm 2019 đến báo cáo Biến đổi khí hậu Phúc trình của IPCC báo động đỏ cho nhân loại 82021 (15.01.2020)

- Tỉ phú giàu nhất thế giới dự báo thảm họa kinh tế xảy ra sớm (23.06.2022)

- Tại sao sóng nhiệt xảy ra thế giới ngày càng dữ dội? (23.06.2022)

- Trung Quốc có chút ngần ngại khi cùng Nga đe dọa Nhật Bản (23.06.2022)

Yahoo:

Yahoo: